Emotional Intelligence: The Sustainable Edge Behind Consistent Trading Performance

Emotional intelligence is the real edge in trading. Learn how to turn discipline, self-awareness, and structured risk control into consistent performance.

Emotional intelligence is the real edge in trading. Learn how to turn discipline, self-awareness, and structured risk control into consistent performance.

Spreads, swaps, and commissions in FX—how they work, how to calculate all-in costs, and how to lower them with a clear framework and real-world examples.

Learn what insider trading regulations mean in 2025. Understand Rule 10b5-1, MNPI, SEC enforcement, and how to stay compliant.

Learn who regulates trading in the U.S. in 2025. Understand SEC, CFTC, FINRA, NFA roles and how they impact stocks, forex, futures, and crypto.

Learn the best risk management strategies for trading in 2025. Discover how to size trades, set stops, control losses, and stay in the game.

Most traders lose money due to leverage, costs, fragile edges, and behavior. Here’s the math, the rules (PDT), real 2024–2025 evidence, and a risk-first plan.

Practical biofeedback tactics (HRV breathing, micro-resets) to control cortisol, follow your trading rules, and avoid impulse errors—within U.S. regulations.

T+1 settlement speeds cash and compresses risk windows. Learn the real impacts, risks, and step-by-step tactics short-term equity traders should use now.

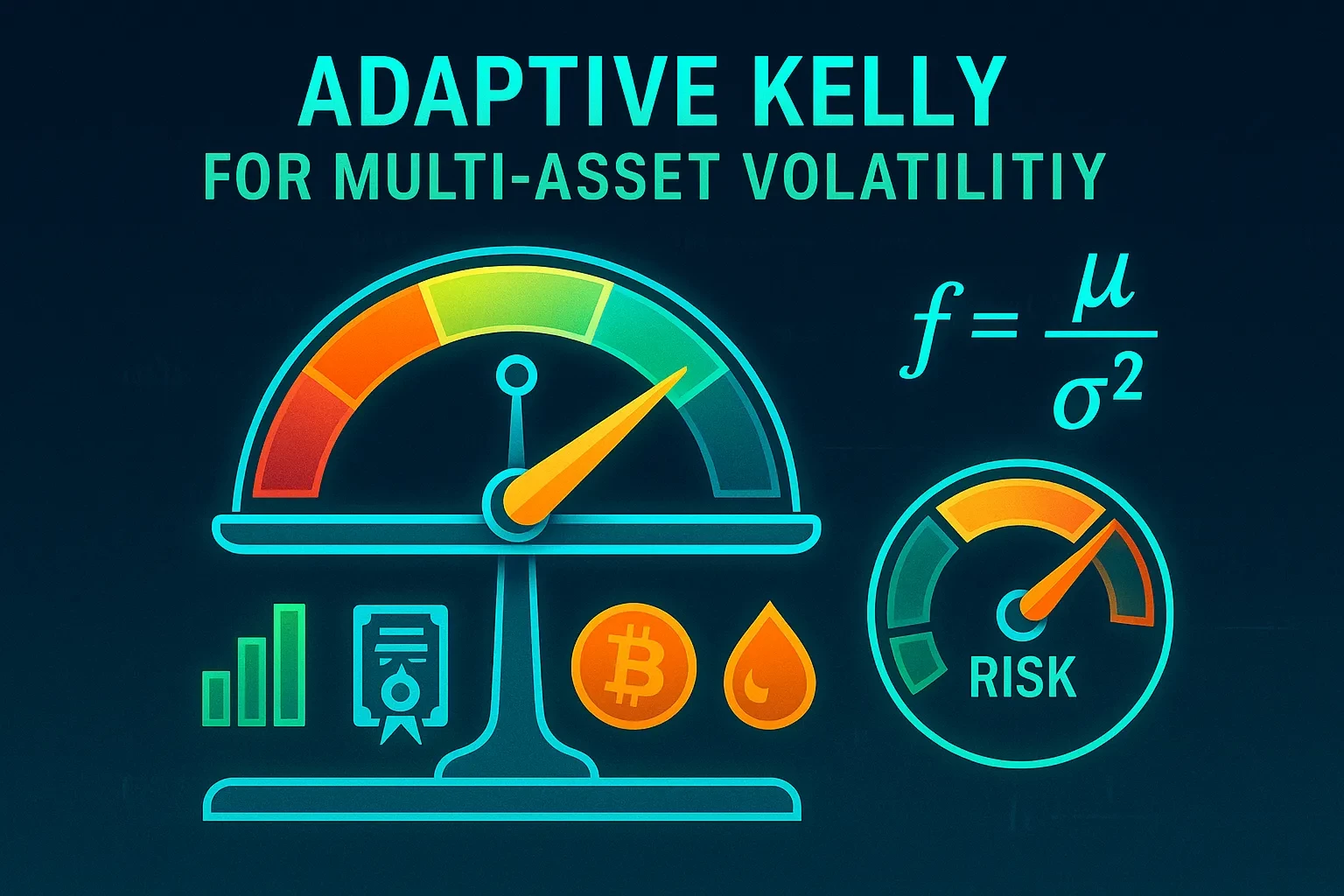

Position sizing for 2025: a practical, risk-first, Adaptive Kelly framework that scales with volatility and correlations—plus guardrails, examples, and U.S. compliance cues.

Prepare your trading bot for a regulator-style algorithm audit with a 7×5 framework, stress-test steps, controls, and 2024–2025 U.S. guidance.

Stress-test your portfolio like a pro: build liquidity, set hard limits, add cost-aware hedges, and rehearse actions to survive rare 5-sigma shocks.

2025 crypto rules explained—what MiCA and U.S. regulators (SEC/CFTC/NFA/Treasury) mean for your trading, plus a practical, compliant playbook.