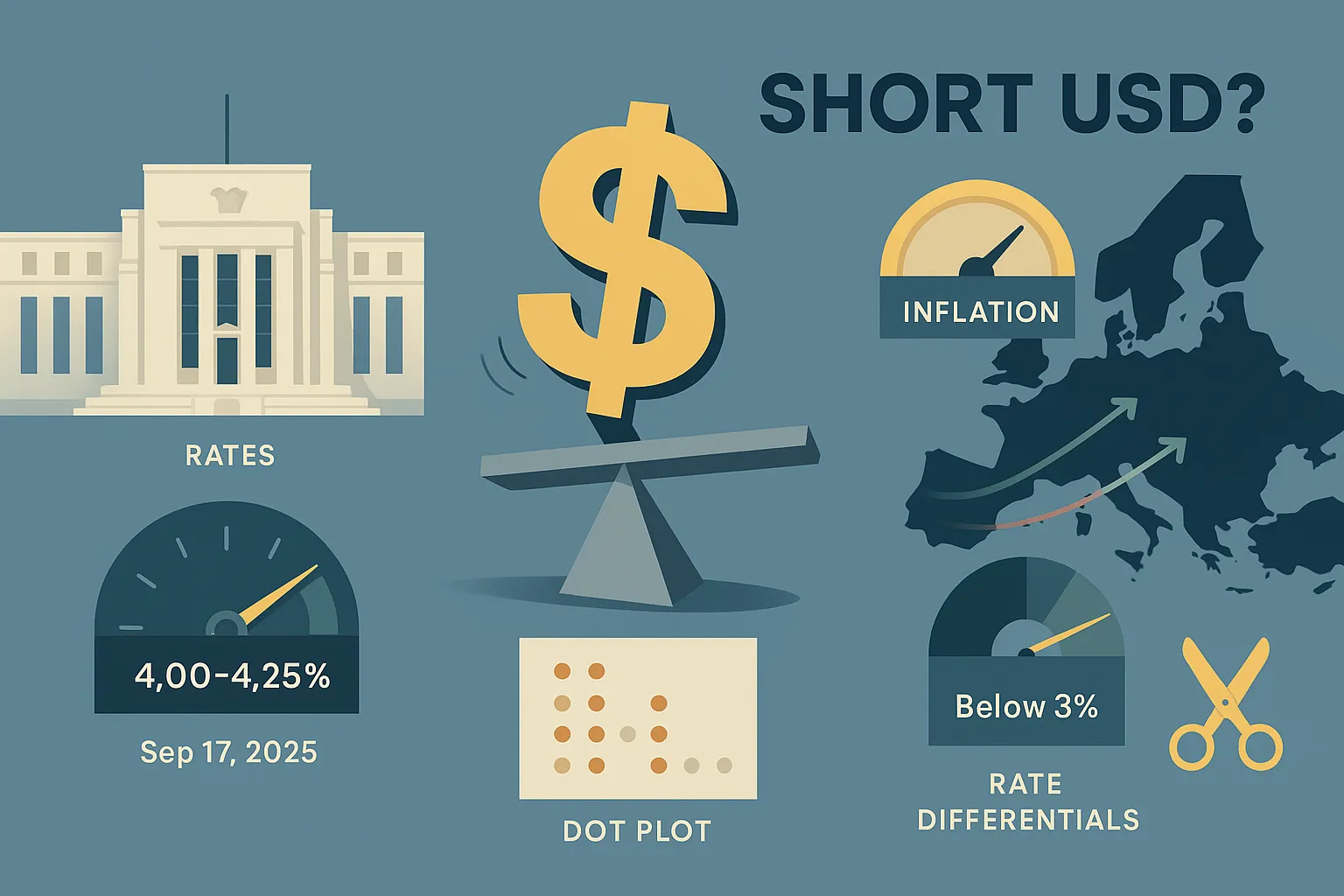

Answer up front: A short-USD bias can work in 2025—but only conditionally. The Fed has begun cutting, global policy is loosening unevenly, and U.S. inflation has cooled. Still, the dollar’s downside depends on whether growth differentials narrow, unemployment rises further, and risk appetite stays resilient. If those pillars wobble, the “short-USD” case weakens. (Federal Reserve, 2025; BLS, 2025).

Disclosure: If you click an affiliate link in this article, we may earn a commission at no extra cost to you. We only link to sources we believe are reputable and relevant.

Table of Contents

Why this matters now

You’re seeing the dollar wobble after a long run of exceptionalism. The Fed cut the policy rate to a 4.00%–4.25% range on September 17, 2025, and its projections (“dot plot”) imply more easing this year if the labor market weakens and inflation keeps drifting toward target. Meanwhile, headline U.S. inflation is running below 3% y/y, giving the Fed some room to pivot. In parallel, Europe and the U.K. are easing too, but at different speeds—creating a messy map of rate differentials, the single cleanest macro driver of G10 FX. In short: 2025 is the first year in a while where a structural short-USD could be more than a trade—if the macro confirms. (Federal Reserve, 2025; BLS, 2025; ECB, 2025).

The 2025 setup—plain-English definitions

• Rate differential: The gap between interest rates across economies (e.g., Fed vs. ECB). A narrowing U.S. premium usually weighs on USD.

• DXY (U.S. Dollar Index): A basket measuring USD vs. majors (EUR ~57%, JPY ~14%, GBP ~12%, etc.). In 2025 the index has trended lower year-over-year. (TradingView, 2025).

• FOMC “dot plot”: Fed officials’ projections for the appropriate policy rate. In Sept. 2025, dots imply scope for additional cuts. (Federal Reserve, 2025).

• COT positioning: CFTC’s weekly snapshot of futures positions. Currency futures show how “leveraged funds” and other categories are tilted. (CFTC, 2025).

• Terms of trade: Export prices relative to import prices. When commodity exporters’ terms improve, their currencies often strengthen vs. USD.

A simple decision framework: T-I-N-A-R-S for the short-USD case

Memorize six pillars. If four or more lean bearish USD, the odds of a sustained short increase.

1) Tightening bias (Fed vs. others)

• Bearish USD when: The Fed is easing faster than peers or signaling a lower terminal rate.

• 2025 status: The Fed has started cutting and indicates openness to more if unemployment rises—dollar-bearish on balance. (Federal Reserve, 2025).

2) Inflation glide-path

• Bearish USD when: Core inflation trends to 2% without growth re-acceleration.

• 2025 status: CPI rose 2.9% y/y in August 2025; core measures are easing. (BLS, 2025).

3) Non-U.S. policy normalization

• Bearish USD when: ECB/BoE credibility improves and they cut in a controlled way, stabilizing growth.

• 2025 status: ECB continued its easing path; BoE kept Bank Rate at 4% and slowed QT to avoid market stress—less headwind to EUR/GBP. (ECB, 2025; BoE, 2025; FT, 2025).

4) Asset-market Appetite (risk)

• Bearish USD when: Global risk appetite is healthy (USD’s safe-haven bid fades).

• 2025 status: Mixed but stable; Fed easing reduces tail risks.

5) Real-yield spreads

• Bearish USD when: U.S. real yields fall vs. Europe/Japan.

• 2025 status: As the Fed cuts and inflation moderates, U.S. real yields compress—modestly dollar-bearish.

6) Speculative Stance (COT)

• Bearish USD when: Specs are net long USD (ripe for a reversal) or stretched in USD-positive crosses.

• 2025 status: CFTC data show evolving positions across EUR, JPY, GBP on the IMM; watch for extended USD-longs unwinding. (CFTC, 2025).

Bottom line: In September 2025, T, I, N, and R lean against the dollar. A and S are less conclusive but no longer strongly USD-supportive.

The macro tape: what changed in 2024–2025

• The Fed’s pivot is real. On Sep 17, 2025, the FOMC cut 25 bps (first since December) and kept the door open to more cuts; the implementation note lowered interest on reserve balances to 4.15%. That narrows dollar-supportive rate gaps. (Federal Reserve, 2025).

• Inflation cooled further. CPI inflation sat at 2.9% y/y in August 2025, reinforcing disinflation. (BLS, 2025).

• Europe isn’t a dead weight. The ECB signaled ongoing easing but with improving balance; the BoE maintained Bank Rate and slowed QT, a constructive signal for gilt stability and GBP risk premia. (ECB, 2025; BoE/FT/Guardian, 2025).

• Price action confirms skepticism. DXY is down on a one-year lookback, reflecting the market’s sense that U.S. exceptionalism is fading at the margin. (TradingView, 2025).

Step-by-step: how to build a disciplined short-USD plan

1) Pick the right expression

• Beginners: Use DXY futures or USD pairs with clear macro stories (e.g., EUR/USD for ECB normalization; GBP/USD for BoE QT slowdown).

• Advanced: Basket shorts—e.g., -40% USD/JPY, -30% DXY, -30% USD/CHF—to diversify event risk.

2) Anchor to data dates

• Create a calendar: FOMC (policy + SEP), U.S. CPI, ECB/BoE meetings, CFTC COT (weekly). Enter only when your thesis aligns with the next data and your stop can live through the event. (Fed/BLS/ECB/CFTC calendars).

3) Define your trigger

• Example: “Short USD on EUR/USD only if (a) Fed guides to another cut and (b) euro-area PMIs beat and (c) spot closes above 200-day MA.”

• No trigger, no trade.

4) Size with math, not hope

• Risk ≤ 0.5%–1% of account per idea. For a 50-pip stop in EUR/USD and a $50k account risking 0.75% ($375), position ≈ 0.75 standard lots (since 1 lot ≈ $10/pip).

5) Place conditional exits

• Hard stop: above/below a structural level.

• Time stop: exit after 10 trading days if momentum stalls.

• Data stop: flatten the day before Fed/ECB if P&L is < +0.5R.

6) Review the three-strike rule

• If you take three short-USD attempts and lose on all (-3R), step back and reassess your macro premise.

One table to keep you honest

| Driver (T-I-N-A-R-S) | What to watch | Current signal (Sep 2025) | Why it matters |

|---|---|---|---|

| Tightening bias | FOMC statements, IOER, SEP | Easing bias | Cuts narrow USD’s rate edge. (Fed, 2025) |

| Inflation path | CPI core/supercore | 2.9% y/y headline (Aug) | Disinflation enables cuts. (BLS, 2025) |

| Non-U.S. policy | ECB, BoE minutes | Orderly easing; BoE slows QT | Reduces tail risks for EUR/GBP. (ECB/BoE, 2025) |

| Appetite for risk | VIX, credit spreads | Neutral | If risk sours, USD bid returns. |

| Real-yield spread | 5y/10y TIPS vs. Bunds | Compressing | Lower U.S. real yields dent USD. |

| Speculative stance | CFTC COT | Not stretched long USD | Limits squeeze power. (CFTC, 2025) |

Takeaway: Four of six pillars tilt against the dollar; the case is constructive but not bulletproof.

Mini case study: turning a macro view into a trade

Scenario (Q4 2025):

• Fed guides to another 25 bps cut; SEP median drifts toward ~3.6% by end-2026; unemployment ticks up. (Federal Reserve, 2025).

• CPI core slips another 0.1–0.2 pp; ECB steady; BoE continues reduced QT. (BLS/ECB/BoE, 2025).

Expression: Long EUR/USD breakout.

• Entry: 1.1250 on daily close above range.

• Stop: 1.1125 (-125 pips) under prior swing low.

• Target 1: 1.1400 (+150 pips) for 1.2R; trail to breakeven.

• Target 2: 1.1650 (+400 pips) if real-yield spread continues to compress.

Position sizing (example): $50,000 account, risk 0.8% = $400; with a 125-pip stop → position ≈ 0.32 lots.

Risk management add-ons:

• Hedge event risk with short EUR 1-week put spread financed by premium if implied vols are low.

• Cut exposure by half ahead of FOMC minutes if unrealized P&L < +0.5R.

Pros, cons, and concrete mitigations

Pros of short-USD stance

• Fed’s easing + disinflation → fewer USD-supportive differentials. (Fed/BLS, 2025).

• Policy normalization in Europe/U.K. reduces idiosyncratic risk premia. (ECB/BoE, 2025).

• Price action agrees: DXY down y/y. (TradingView, 2025).

Cons / what can go wrong

• U.S. growth surprises re-accelerate → real yields back up → USD rallies.

• Risk-off shock (geopolitics, credit stress) → USD safe-haven bid.

• ECB/BoE credibility slips or growth underperforms → EUR/GBP underwhelm.

Mitigations

• Trade baskets, not heroes (split across EUR, GBP, CHF).

• Use trailing stops tied to daily ATR.

• Keep event hedges (options) into top-tier data.

Common mistakes & expert tips

Mistake 1: Trading the dot plot like gospel.

Tip: Treat SEP as conditional guidance. Require confirmed trends in realized inflation and labor data before sizing up. (Federal Reserve, 2025).

Mistake 2: Ignoring positioning.

Tip: Check CFTC weekly; avoid adding when specs are already leaning your way in size. (CFTC, 2025).

Mistake 3: Fading USD without risk plan.

Tip: Hard stop + time stop + data stop. Pre-write them; don’t negotiate with yourself mid-trade.

Mistake 4: Over-concentrating in USD/JPY.

Tip: USD/JPY adds BoJ-specific risks; diversify expression unless you have a clear BoJ view.

Compliance: the U.S. regulators you should know

• Federal Reserve (monetary policy): Sets the fed funds range and balance-sheet approach. (Federal Reserve, 2025).

• CFTC / NFA (derivatives): CFTC publishes Commitments of Traders; NFA oversees forex dealer members and registered firms. (CFTC, 2025).

• SEC (securities): If you use USD-linked ETFs or currency-hedged equity funds, their disclosures/filings fall under SEC rules.

Plain-English risk disclaimer:

Trading currencies, futures, and options involves significant risk of loss and isn’t suitable for every investor. Past performance doesn’t guarantee future results. This article is educational and not investment advice. Always test ideas on a demo and consult a qualified advisor on suitability.

FAQ

Action-oriented next steps

• Backtest your short-USD triggers on 2024–2025 data (Fed days, CPI days).

• Paper trade a diversified basket for 30 sessions with fixed risk and pre-set exits.

• Instrument choice: If new to FX, consider regulated vehicles (e.g., listed futures) and brokers under CFTC/NFA oversight. (CFTC, 2025).

• Education library: Bookmark the FOMC statement/SEP pages and the BLS CPI calendar; update your T-I-N-A-R-S score weekly. (Fed/BLS, 2025).